News.com.au article on “Suburbs where house prices will plunge” is riddled with misinformation

The News.com.au article “Suburbs where house prices will plunge” is riddled with misinformation and at times, cherry-picking of data from 3rd party sources.

The research done on housing markets by this media outlet was not only cherry-picked but for the most part, picked from the sources that don’t produce these datasets. Conducting thorough research has become essential and an ethical responsibility that news media should take before publishing opinion pieces like these – if they want to be taken seriously as an authority on the topic.

The writer of the piece takes an opinion from multiple resources belonging to the same business and uses that as fact for their entire argument on why house prices will fall in these areas. This is very irresponsible journalism as this has major bearing on people’s decision

So let’s discuss it point by point and understand why this article is so troublesome –

Being Lazy with the research –

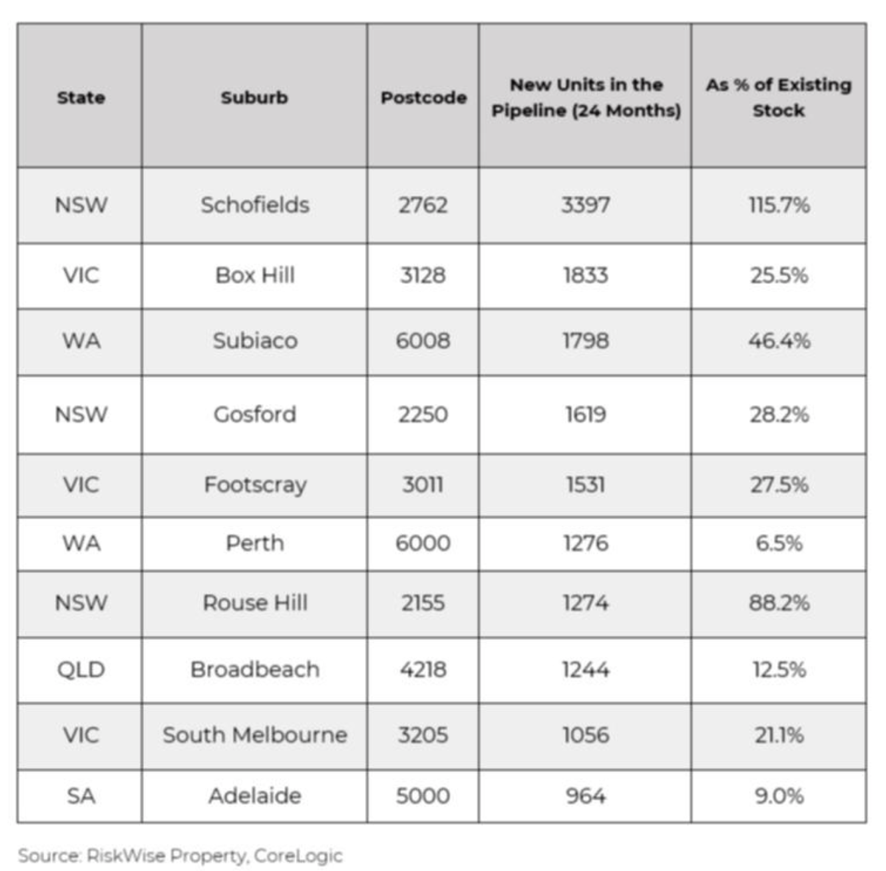

If anything, the research company “Risk Wise Property” has been a bit lazy with their data sourcing. How? Let’s take a deep dive into the table exhibit below.

Risk Wise has shown CoreLogic as the source of the data. Usually, the prime source of such data is the council or government’s own forecast ID. However, in this case, we don’t have that. So, where did the data come from? The big problem is that neither of them is 100% accurate or reliable. Most experts would not recommend using such forecasting tools without understanding their limitations and how to apply further analytics on top of it. All these factors make Riskwise’s argument a bit weak. Also understand, if you are acquiring second-hand data and if there is any mistake committed, then that mistake will be reflected in your insights…in this case, it can be clearly seen in this article. For any data-driven insights and opinion pieces, make sure you check with two or three sources before publishing.

Showing Supply, but not Demand forecast to create panic amongst Australians –

How can you showcase supply data but purposefully exclude demand data? That doesn’t make sense, right? E.g. the article deliberately did not mention any data on population growth in these areas. Imagine how much it would have helped customers if Risk Wise had shown data on Supply and Demand. But alas, fear sells better!

What is a better data set? –

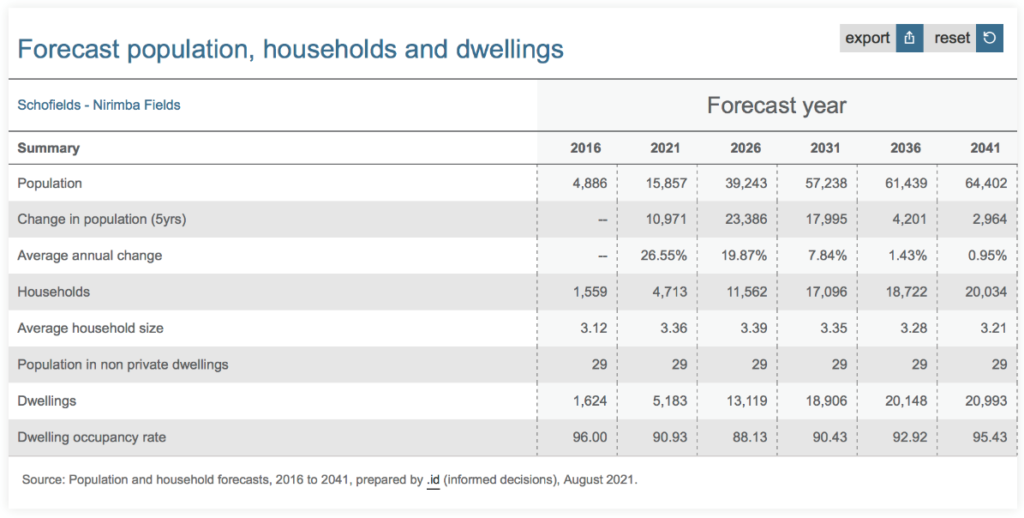

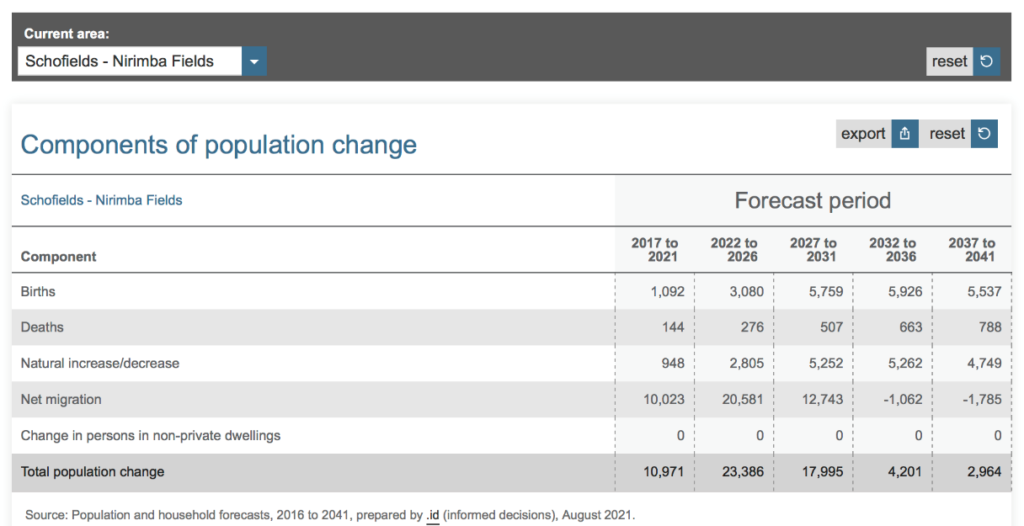

Have a look at the table below (source: https://forecast.id.com.au/blacktown/population-households-dwellings?WebID=400 ). As you can see, by 2026, Schofield’s population will rise to 23,386 and to address this population rise, we will only have 13,119 dwellings. So we are kind of under-supply or optimum supply for future growth. This is data from the Blacktown City Council website. If you refer to Average house hold size, it is increasing over the next 5 years, leading upto 2026. Now that we are predominantly going to see more units, which are traditionally smaller dwelling, average household size is still surging. This is an important indicator of growing family size and proportionately stronger demand. Massive inter suburban migration can also be seen in the component of Population change data produced by government.

The legitimacy of research body –

The article suggests that it has taken reference from two different networks i.e. RiskWise Property Research and BuyersBuyers. Unfortunately, both RiskWise and BuyersBuyers are run by the same people. Not sure why this article is written to believe that two separate companies have prepared two independent data sets. Isn’t that misinformation?

To add to the frustration of the poor research, Risk Wise CEO Doron Peleg says investments in these suburbs can carry an increased risk of rental vacancies and capital loss- particularly for new or off-the-plan purchases. It couldn’t have been far from the truth. One of the critical elements that determine the future capital value loss is the current value people are buying the properties for and a multitude of factors which are beyond anyone’s control. I guess we all saw it last year when COVID hit, everyone was out there to hammer the property markets and make quick predictions about 20-35% drop and in a short span of 9 months everyone was proven wrong.

As consumers, ask yourself a simple question: What if the builders have already factored in that risk and priced the product accordingly?

Blaming it on migration

Ok, agreeably, international migration is a factor but is not the only factor. Unit prices are not just driven by migration; they are driven by affordability, Income Level, Burrowing, Better Yield and Proximity to Infrastructure. This is Property 101 that the research company forgot to research on. On reference to components of population change, you will see that majority of population movement is inter suburban. Taking an example of Schofields, top pick of this article, I would suggest that it will be worth noting that such suburbs rarely see new migration form overseas. Typically you will see migrants who have been in Australia for few years who traditionally move to such suburbs. This is where micro level understanding of the suburban variable will come in handy.

As consumers of information online, always remember that news articles such as these are based on only one thing – sensationalisation and fear-mongering. Do your research, as most of the data is available on all local council and government websites. Give us a call if you need more insights on these suburbs, and we will be more than happy to diminish misinformation.